Looking for No Annual Fee Credit Cards in UAE?

Sale of bodybuilding product in tunisia, buy steroids lyon harneycountybirdfest steroids for weight loss mini-satan: bodybuilding training log.

Then you’re in the right place.

While the plethora of luxury credit cards in UAE charge an annual fee, a vast array of top-tier credit cards offer ample rewards without an annual fee.

In fact, these include some of the best credit cards around.

Summary of No Annual Fee Credit cards in UAE

The table shows a basic summary and comparison of different credit cards in UAE.

Credit cards | Card Feature | Minimum Salary Requirement | Apply Credit card |

|---|---|---|---|

| Citi Bank Simplicity Credit card | No late fee and over limit fee. No cash advance fee. 20% offers on selected restaurants. Unlimited access to selected airport lounges in the Middle East | 5000 AED | Apply Now |

| CBD Visa Infinite Card | Unlimited Airport Lounge Access. Free Travel Insurance 50% discounts on VOX tickets online. | 30,000 AED | Apply Now |

| CBD Visa Platinum Credit Card | Redeem points for Skywards miles. Discounts on movie tickets. Discounts on AVIS car rentals. | 8000 AED | Apply Now |

| CBD eTijari Web Card | Used only for internet transactions. Facility to set your own credit limit. | 8000 AED | Apply Now |

| ADIB Value Plus Card | Up to 25% discount on dining. Get rewards on your domestic & international spends. Enjoy up to 25% discount on dining across the UAE. | 5000 AED | Apply Now |

| Noor Bank Priority World Credit card | Each 2 points (2% of spend) for every AED 1 you spend on your credit card. Airport pick up & drop off 12 times a year. Free golf for 2 people at Arabian Ranches Golf Club Dubai. | 35,000 AED | Apply Now |

| Najm Platinum Cashback Credit Card | Exclusive offers and dedicated checkout counters at Carrefour. Monthly cashback savings up to AED 200. 30% discount on dining. | 7,000 AED | Apply Now |

List of No Annual Fee Credit Cards In UAE

Here are some of the best collection of credit cards that offers maximum benefits for their customers with no annual fee.

1. Citibank Simplicity Credit Card:

Card Description :

The Citibank Simplicity Credit Card has proven to be the stand-out round no annual fee credit card in UAE 2021 and is maintaining its popularity in 2022.

The Citibank Simplicity Credit Card has proven to be the stand-out round no annual fee credit card in UAE 2021 and is maintaining its popularity in 2022.

It is basically a free-for-life & low-interest credit card which offers an interest rate of 3.5 % of the outstanding amount with up to a 51 day interest free period.

If you are that forgetful type who tends to run late on payments, don’t worry.

There is no late time fee ever for this simplicity card.

Main Features of Citibank Simplicity Credit Card

- No Late Time Fee – Ever

- No Over Limit Fee- Ever

- No Annual Fee – Ever

- No Cash Advance Fee – Ever

- Minimum Salary Required is 5000 AED.

Benefits of Citibank Simplicity Credit Card:

- Shopping and Dining Credit Card.

- Unlimited lounge access in selected airport lounges across the Middle East.

- Complimentary Travel Insurance and Purchase Protection.

- Get hundreds of Buy 1 Get 1 free offer across hotels, dining, spas, leisure & entertainment in cities throughout the Middle East & Africa.

Click here to Apply for Citibank Simplicity Credit Card.

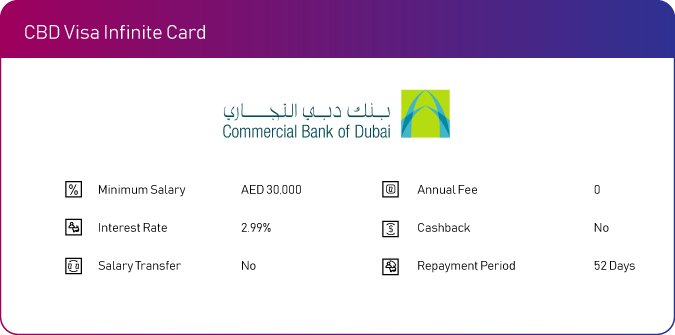

2. CBD Visa Infinite Card:

Card Description :

The CBD Visa Infinite Credit Card is an excellent option for those who want to take advantage of balance transfer and are averse to paying an annual fee.

The main advantage of this credit card is that it can act both as a low-balance transfer card and as a cashback rewards card all in one. This Credit card is great to redeem reward points for skyward air miles.

Major Features of CBD Visa Infinite Credit Card

- Conventional Balance Transfer Credit Card.

- Interest rate on this card is 2.99%.

- Earn Attijari Points for all your purchases and you can redeem them for cashback.

- Attijari points can be converted for Skywards Miles.

- Minimum Salary Required is 30,000 AED.

Benefits of CBD Visa Infinite Credit Card

- Unlimited access to VIP lounges globally.

- Concierge service is available at airports with this card.

- Avail airport dining discount program with dragon pass.

- Free valtrans valet parking at different locations in UAE.

- Earn 2.5 Attijari points on international spending, 2 points on local spending, and 1 point for groceries and supermarkets.

- 50% discount on VOX Cinema tickets. (T&C Apply).

- Get discounts on dining, shopping, and travel.

Click Here to Apply for CBD Visa Infinite Credit card

3. CBD Visa Platinum card

Card Description:

The CBD Visa Platinum Card ticks off all the boxes of a great balance transfer credit card.

Plus, the card has no annual fee, a low-interest rate of 2.99% as well as cashback on purchases.

Major Features of CBD Visa Platinum Credit Card

- Zero Balance Transfer offers.

- Interest rate on this card is 2.99 %.

- Discounts with Agoda.

- Redeem points for Skywards miles or cashback.

- Minimum Salary Required is 8000 AED.

Benefits of CBD Visa Platinum Credit Card

- Attijari points can be converted for Emirates Skywards or Etihad Guest Miles.

- Repayment period of 52 days.

- Attijari Points Rewards Program – earn up to 2.5 points for every Dirham spent.

- Get Airport Dining Discount Program with Dragon Pass.

- Offers free multi-trip travel insurance

Click here to Apply for CBD Visa Platinum Credit Card.Â

4. ADIB value plus card

Card Description :

The ADIB Value Plus Card could be the one worth considering , if you’re looking for a card that will give you valuable cash rewards on every purchase.

Earn reward points while you spend and enjoy the flexibility of converting them into shopping or dining vouchers, airline tickets and more.

Main Features of ADIB Value Plus Card

- An Islamic Credit Card with a low salary requirement.

- Interest rate on this card is 3.09%.

- Get rewarded for local and international spend

- Minimum Salary Required is 5000 AED.

Benefits of ADIB Value Plus Card:

- Access to airport lounges across GCC/MENA Region.

- Get up to 25% discount on select dining outlets across the UAE.

- ADIB Reward Points can be redeemed for airline tickets.

- Earn 1 reward point for 1 AED on domestic spending & 2 reward points for every 1 AED on international spending.

- Facilities like Roadside assistance.

- You can redeem points for shopping vouchers.

Click Here to Apply For ADIB Value Plus Credit Card

5. Noor Bank Priority World Credit Card

Card Description:

The Noor Bank Priority World Credit Card has been designed with UAE golfers in mind.

If you’re a frequent golfer, you may be able to reap some rewards for doing what you love.

Main Features of Noor Bank Priority World Credit Card

- This card is an Islamic Card.

- Free Access to Premium Gyms (T&C Apply).

- Free Golf for two people (T&C Apply).

- Balance Transfer and Credit shield facilities.

- Minimum Salary Requirement is 35,000 AED.

Benefits of Noor Bank Priority World Credit Card

- Free access to selected gyms in Dubai and Abu Dhabi.

- Get 6 free valet parking services per month at selected locations.

- Unlimited Airport lounges access around the world.

- The airport picks up and drops off (6 times a year).

- Marhaba meets and greets services.

- For every Dirham you spend on your credit card, you earn 1.5% cashback on domestic spending and 2% cashback on International Spends

Click Here to Apply for Noor Bank Priority World Credit card

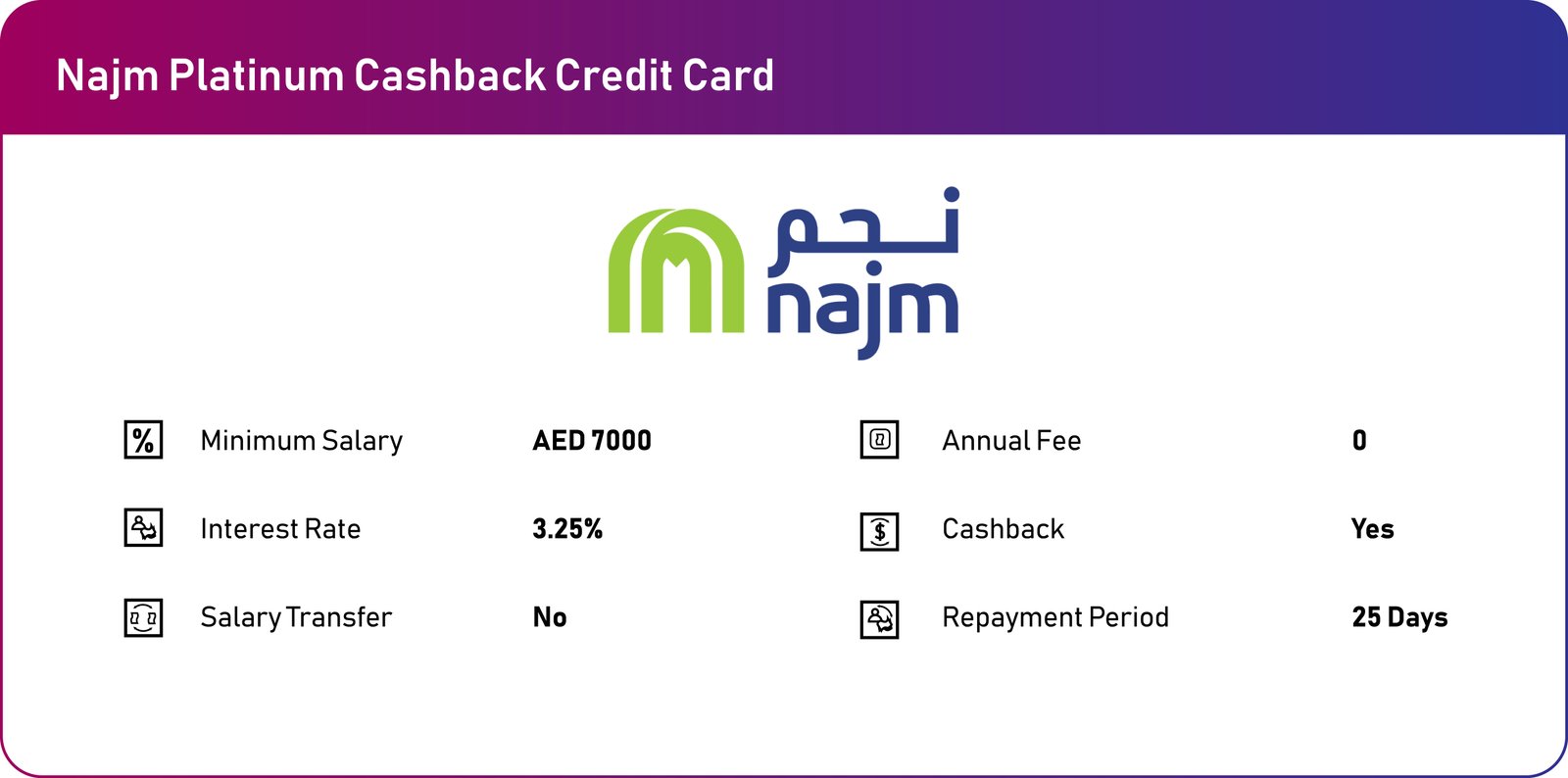

6. Najm Platinum Cashback Credit Card

Card Description :

The Najm Platinum Cashback Credit Card is designed for saving money on groceries.

You can maximize your savings with this card and get exclusive category discounts and offers at Carrefour.

Main Features of Najm Platinum Cashback Credit Card

- Free for Life Credit Card.

- Balance Transfer Facility.

- Monthly cashback savings of up to AED 200.

- Dedicated check-out counters at Carrefour.

- Visa Platinum Extended Warranty.

- Minimum Salary Requirement is 7000 AED.

Benefits of Najm Platinum Cashback Credit Card

- 3% Cashback every Tuesday and 1.5 % every day at Carrefour.

- Free unlimited Valet Trolley at Carrefour.

- Visa Platinum discounts on dining, shopping, travel & cinemas.

- Visa Platinum Purchase Protection.

- Weekly category discounts & exclusive offers at Carrefour.

Click here to Apply for Najm Platinum Cashback Credit card

How to Choose No Annual Fee Credit cards in UAE

There is no single best “no annual fee credit card†as the cardholders have different expectations and requirements, here are some of the factors you can prefer when choosing them.

Fees: Consider other fees like foreign transactions, balance transfer fees, and more in a No annual fee credit card.

Rewards Rate: Choose the credit card that provides the higher value for each purchase and look for cashback offers.

Staying Power: Go with a credit card that favors long-term utility over short-term rewards, this is suitable if the cardholders prefer to hold the credit card for several years.

Sign-up Bonus: Prefer no annual fee credit card that offers sign-up bonus so that you can avail yourself set of benefits with them.

Other Perks: Also check whether the no annual fee credit card has some other unique benefits like airport lounge access, discount on movie tickets etc.